Silver – “The indispensible metal”

Silver is a precious metal, and like gold, it has intrinsic value. Silver is widely perceived to be both a commodity and a form of money, and has been used as a medium of exchange for thousands of years due to its inherent value.

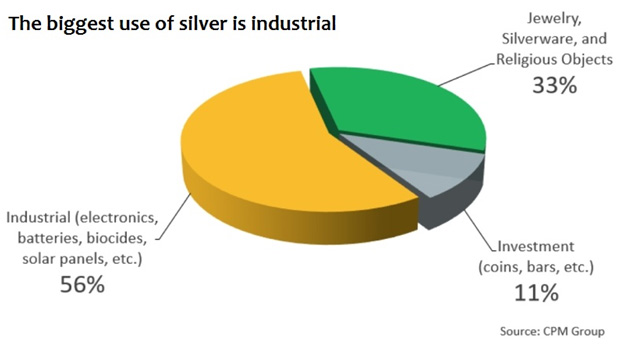

Today, silver’s primary use is industrial, whether being used in cell phones or solar panels; new innovations are constantly emerging to take advantage of silver’s unique properties.

Silver is a noble metal that resists corrosion and oxidation. With the best thermal and electrical conductivity of all metals, silver is ideal for electrical applications. Its antimicrobial, non-toxic qualities make it useful in medicine as well as consumer products. The high lustre and reflective properties of silver make it perfect for jewellery, silverware, and mirrors. Its malleability allows it to be flattened into sheets, with ductility enabling it to be drawn into thin, flexible wire, making it the best choice for industrial applications. Additionally, its photo-sensitivity has given it a place in film photography.

What is Silver used for?

Silver is invaluable to solder and brazing alloys, batteries, dentistry, glass coatings, LED chips, medicine, nuclear reactors, pharmaceuticals, photography, RFID chips, semiconductors, solar energy, touch screens, water purification, wood preservatives, satellites, x-rays, as well as numerous other industrial purposes. Washington-based industry group the Silver Institute calls it “the indispensable metal”.

Silver Supply & Demand

Silver market physical surpluses and deficits explain, and on occasion, influence the price, margins, premiums, and lead times. Physical surpluses and deficits are not the only influence on short term price fluctuations. Unlike solely industrial metals, there is also substantial demand for silver as a financial asset. In 2016, Exchange Traded Product holdings rose to a record high with approximately a fifth of demand for new silver generated by the physical silver coin and bar sector with investors increasing their private holdings.

Silver has an active Over-the-Counter market, which acts as a mechanism for risk and price management. OTC trade can have an important impact on silver prices because of the size and scale of this market segment.

Silver is also held as an above-ground asset by private and institutional investors, users, dealers, banks, and other entities. Increases or decreases in these stocks, whether accumulations or sales into terminal markets, affect prices as well.

Sources:

The Silver Institute

World Silver Survey 2017

Geoscience News and Information

Thomson Reuters