Related Document

Vancouver, BC – March 2, 2020 - Silver One Resources Inc. (TSXV: SVE; OTC Pink: SLVRF; FSE: BRK1 - “Silver One” or the “Company”) is pleased to report initial results of the ongoing diamond drill program at its Candelaria project, Nevada. Drilling completed to date consists of a total of 2,295 meters drilled in 7 holes. Assays of 5 holes received have confirmed high-grade silver mineralization below and north of the Mount Diablo pit limits and the down-dip continuation of the mineralization north of the Mount Diablo pit. One high-grade down-dip intercept in hole SO-C-19 047 returned 1,129 gm/t silver over 8 m true width, within a 27.62 meter interval that averaged 350 gm/t silver (see table below).

Silver One’s President and CEO, Greg Crowe commented “We are very pleased with the results received to date. Twin holes 47 and 48 illustrate the potential continuity of high-grade silver mineralization at depth and provide confirmation of previous analytical results obtained by Silver Standard drilling in 2001-2002. These results will allow for an updating of Silver Standard’s historic 43-101 resource, which is well underway. We are also seeing down-dip continuation of the Mount Diablo mineralization, where the farthest hole drilled has extended the mineralized manto for an additional 100 meters. These results are very encouraging. Additional drilling is warranted, not only down-dip, but between the two historic pits and along-strike to test undrilled areas with the objective of potentially expanding the limits of the known mineralization.”

| Drill Hole | From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

AgEq (g/t) |

Notes |

| SO-C-19-046 | 98.00 | 100.00 | 2.00 | 0.14 | 112.03 | 124.62 | Oxides |

| and | 141.66 | 163.76 | 22.10 | 0.32 | 158.54 | 186.77 | Oxides LCS |

| includes | 141.66 | 152.00 | 10.34 | 0.16 | 81.63 | 95.63 | Oxides |

| includes | 152.00 | 160.00 | 8.00 | 0.63 | 313.67 | 369.17 | Oxides |

| includes | 160.00 | 163.76 | 3.76 | 0.11 | 39.99 | 49.32 | Oxides |

| and | 180.00 | 182.00 | 2.00 | 0.01 | 26.40 | 27.28 | Ox. Foot wall of LCS |

| SO-C-19-047 | 260.00 | 264.00 | 4.00 | 2.64 | 16.15 | 248.34 | PickHandle Thrust mineralization |

| and | 272.00 | 299.62 | 27.62 | 0.45 | 350.11 | 389.54 | LCS |

| includes | 272.00 | 278.00 | 6.00 | 0.10 | 43.47 | 52.59 | Oxides |

| includes | 278.00 | 286.00 | 8.00 | 1.33 | 1,129.43 | 1,246.03 | Oxides |

| includes | 286.00 | 299.62 | 13.62 | 0.08 | 27.45 | 34.91 | Oxides |

| SO-C-19-048 | 325.73 | 342.29 | 16.56 | 0.58 | 318.27 | 369.45 | Oxides |

| includes | 325.73 | 334.00 | 8.27 | 0.95 | 501.88 | 585.09 | Oxides |

| includes | 334.00 | 340.20 | 6.20 | 0.10 | 47.20 | 55.75 | Oxides |

| includes | 340.20 | 342.29 | 2.09 | 0.58 | 395.90 | 446.76 | Mixed Ore |

| and | 344.99 | 348.00 | 3.01 | 0.07 | 28.84 | 34.65 | Sulphides |

| SO-C-20-049 | 330.00 | 349.98 | 19.98 | 0.29 | 96.47 | 122.14 | Mixed Ore |

| includes | 330.00 | 334.00 | 4.00 | 0.34 | 25.60 | 55.78 | Mixed Ore |

| includes | 334.00 | 345.06 | 11.06 | 0.37 | 137.08 | 169.57 | Mixed Ore |

| includes | 345.06 | 349.98 | 4.92 | 0.08 | 62.80 | 69.47 | Mixed Ore |

| SO-C-20-050 | 306.04 | 331.63 | 25.59 | 0.31 | 172.16 | 199.37 | Oxides |

| includes | 306.04 | 322.00 | 15.96 | 0.41 | 231.50 | 267.56 | Oxides |

| includes | 322.00 | 331.63 | 9.63 | 0.14 | 73.82 | 86.35 | Oxides |

Width and grades at Mount Diablo are in line with historic results reported by Silver Standard in the areas of the Mount Diablo and Northern Belle open-pits. Average thickness of the main mineralized zone, called Lower Candelaria Shear (“LCS”, ) is 22m. Orebody thicknesses hold up well down-dip, with intercepts piercing the mineralized body up to 400 meters north of the lower limit of the Mount Diablo pit (Hole 49). This lies approximately 100 meters north of the nearest historic hole. Total widths of the LCS in the 5 holes assayed vary from 16 meters to 27 meters (average 22 meters) with silver equivalent grades between 122 g/t and 389 g/t. The “LCS” includes a higher-grade core (highlighted in yellow in above table) that ranges in width from 8 meters to 16 meters, with a silver equivalent grades between 1,246 g/t and 270 g/t (see table above). The use of special muds and additives, coupled with careful, expert drilling have helped achieve excellent core recoveries of over 98%. The use of core has greatly aided our understanding of the geological and structural controls on the mineralized system, beyond what was achieved by earlier reverse-circulation drilling.

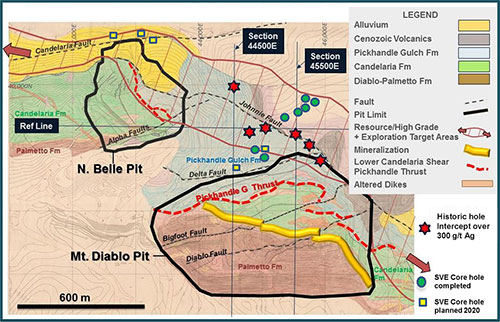

Drill hole collars are shown on the map below:

QA/QC

The QA/QC program for the 2019-2020 drilling at Candelaria included the submission of Certified Reference Materials, blanks, core duplicate, as well as the insertion of crushed duplicates and pulp duplicates at random intervals. Certified Standards were inserted at a rate of one standard for every 20 samples (5% of total) and one blank for every 20 samples (5% of total). Core, pulp and crush duplicates combined were inserted at a rate of one duplicate per every 20 samples (5% of total). The standards used in the 2019-2020 Candelaria drilling program range in grade from 24.8 g/t Ag to 493.0 g/t Ag, and were sourced from Analytical Solutions, Ltd., in Mulmur, ON, Canada. Blanks have been sourced

locally from barren silica and marble material. Field core duplicates were obtained from quartered core, crush and ‘pulp’ duplicates were taken from coarse reject material or pulverized splits respectively.

Samples were assayed by American Assay Laboratories (“AAL” in Sparks, NV, USA. (IAS accredited Laboratory, ISO/IEC 17025:2005. AAL also inserts blanks, standards and includes duplicate analyses to ensure proper sample preparation and equipment calibration.

Qualified Person

The technical content of this news release has been reviewed and approved by Greg Crowe, P. Geo, President and CEO of Silver One, and a Qualified Person as defined by National Instrument 43-101.

About Silver One

Silver One is focused on the exploration and development of quality silver projects. The Company holds an option to acquire a 100%-interest in its flagship project, the past-producing Candelaria Mine located in Nevada. Potential reprocessing of silver from the historic leach pads at Candelaria provides an opportunity for possible near-term production. Additional opportunities lie in previously identified high-grade silver intercepts down-dip and potentially increasing the substantive silver mineralization along-strike from the two past-producing open pits.

The Company has staked 636 lode claims and entered into a Lease/Purchase Agreement to acquire five patented claims on its Cherokee project located in Lincoln County, Nevada, host to multiple silver-copper-gold vein systems, traced to date for over 11 km along-strike.

An option agreement has been entered into by Silver One to acquire a 100% interest in the Phoenix Silver property. The Phoenix Silver property is a very high-grade silver opportunity, located in Gila County, Arizona

In addition, the Company also holds a 100% interest in three significant silver assets located in Mexico – Peñasco Quemado, Sonora; La Frazada, Nayarit; and Pluton, Durango, acquired from First Mining Gold, one of the Company’s largest shareholders.

For more information, please contact:

Silver One Resources Inc.

Gary Lindsey - VP, Investor Relations

Phone: 604-974‐5274

Email: gary@strata-star.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management’s current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Silver One cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Silver One’s control. Such factors include, among other things: risks and uncertainties relating to Silver One’s limited operating history, ability to obtain sufficient financing to carry out its exploration and development objectives on the Candelaria Project, obtaining the necessary permits to carry out its activities and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Silver One undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.