Related Document

Vancouver, BC – December 13, 2022 - Silver One Resources Inc. (TSXV: SVE; OTCQX: SLVRF; FSE: BRK1 - “Silver One” or the “Company”) announces positive initial bottle-roll metallurgical test results from six large-diameter core (“HQ and NQ”) holes and three in-pit bulk samples from its Candelaria Project located in western Nevada, USA. More definitive results are expected from column leach tests, and flotation tests on sulphide-rich samples being conducted by Kappes, Cassiday & Associates (“KCA”) in Reno, Nevada. These results are expected in Q1 2023.

Highlights:

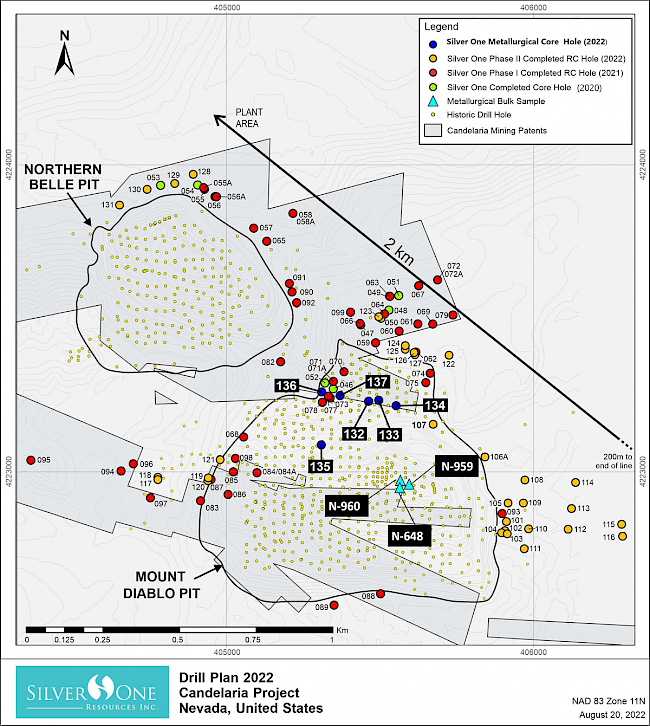

- Six composites from mineralized intervals in diamond drill holes completed in September 2022, and three bulk samples of oxide and mixed material collected at the base of the Mt. Diablo open-pit were sent to KCA in Reno, Nevada for metallurgical testing (see Figure 1 below for hole and bulk sample locations). The diamond drill holes represent oxide, mixed (oxide and sulphide) and sulphide-rich mineralization (see Figure 2, photos of sulphide-rich mineralization).

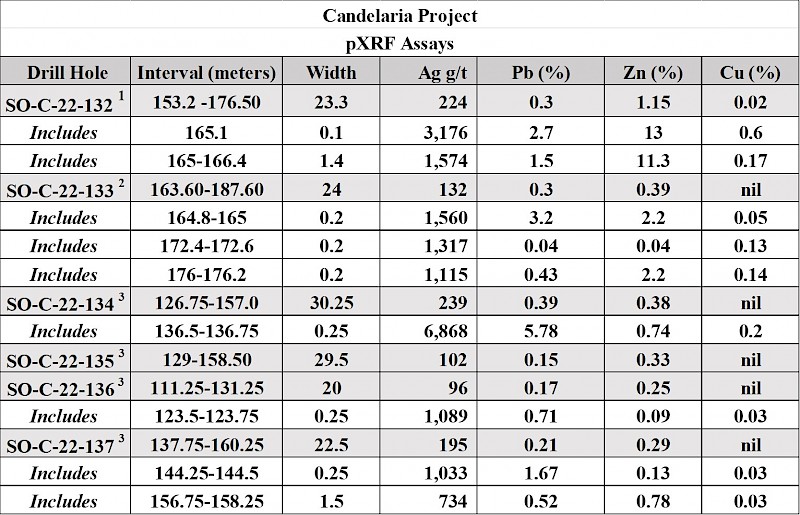

- Field portable XRF (pXRF) point analysis from sulphide-rich mineralization in hole 132 returned 3,176 g/t silver, 0.6% copper, 2.7% lead and 13.0% zinc, within a 23.45 m wide mineralized zone assaying 359 g/t silver and 0.7 g/t gold reported by KCA’s lab.

- pXRF point analysis of oxide mineralization in hole 134 returned 6,868 g/t silver, 0.2% copper, 5.78% lead and 0.74% zinc, within a 30.2 m wide mineralized zone assaying 149.9 g/t silver and 0.3 g/t gold reported by KCA’s lab. Technical details and relevant high-grade pXRF results are shown in Table 1.

- The sulphide results are significant as they confirm the known extent of high-grade mineralization north of the Mt. Diablo pit.

- Drill holes SO-C-22-132 and 133 intersected relatively shallow high-grade sulphide mineralization at depths approximately 200 m below the pre-mining surface, while the oxide zone throughout the deposit generally extends to depths of 250 m.

- Examples of the deeper sulphide intercepts include holes 079 and 072A which are the northernmost holes drilled to date and their grades are as follows:

- Hole SO-C-21-072A assayed 330 g/t Ag and 0.44 g/t Au over 4.57 m, from 435.86 m, within a 14 m zone averaging 198 g/t Ag and 0.28 g/t Au, from 432.82 m.

- Hole SO-C-21-079 assayed 476.5 g/t Ag and 1.47 g/t Au over 3.05 m, from 315.47 m, within a 7.62 m wide zone averaging 273 g/t Ag and 0.74 g/t Au, from 312.42 m (See Figure 1, and August 16, 2022 news release).

- This mineralization remains open at depth, north of the Mt. Diablo pit, and potential extensions to this system have yet to be drill-tested.

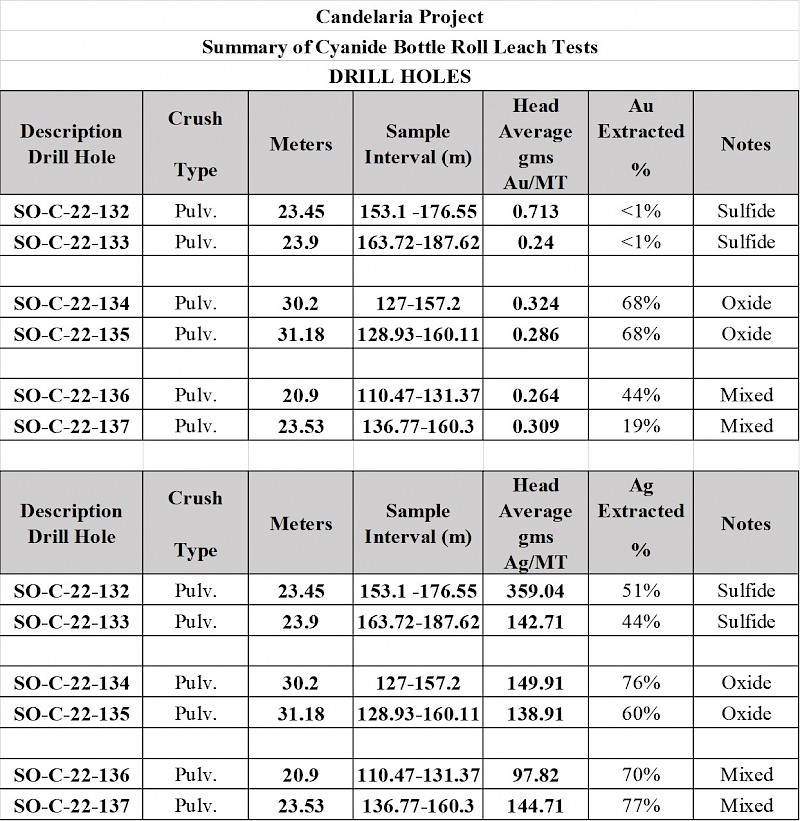

- Initial bottle-roll tests reported extractions ranging from 60% to 76% silver, and 68% gold in the oxide diamond drill intercepts; from 70% to 77% silver and 19% to 44% gold in the mixed (oxide-sulphide) diamond drill intercepts; and from 44% to 51% silver and 1% to 3% gold in the sulphide diamond drill intercepts (Table 2).

- The sulphide-rich intervals are also being tested at KCA by flotation methods, which are expected to return higher recoveries as the sulphide does not as readily react to cyanide leaching as does the oxide mineralization. Results should be received in Q1 2023.

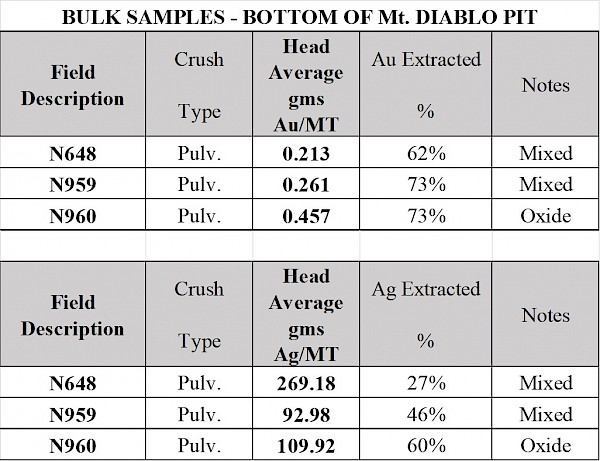

- The initial bottle-roll test extractions for the oxide and mixed bulk samples collected in the Mt. Diablo open-pit ranged from 27% to 60% silver and 62% to 73% gold (Table 2). The lower than expected silver extractions on the mixed (oxide-sulphide mineralization) are likely to be mineralogy specific to those samples and may not be representative of the entire pit bottom.

Gregory Crowe, President and CEO commented; “We are encouraged by the initial bottle-roll test results and await all of the column leach test results expected in Q1 2023. We are also pleased by the high-grade sulphide-rich intercepts in hole 132, which represent shallow depths of sulphide-rich mineralization. We anticipate more sulphide-rich mineralization down-dip (north) from the Mount Diablo open-pit, which remains open for future exploration. If the grade of sulphide mineralization in hole 132 is an indication of potential grades associated with untested sulphide-rich mineralization elsewhere, this makes further down-dip exploration a high-priority target.”

Figure 1. Drill holes in the area of Mount Diablo and Northern Belle pits (see Corporate Presentation at www.silverone.com for assays of select down-hole intercepts).

Figure 2. Photographs: Sulphide samples from drill hole SO-C-22-132. Mineralization includes massive sulphides such as pyrite, galena, sphalerite, and lesser chalcopyrite in bands, stockwork or filling breccia, with rims of native silver around the sulphides. (a) Single point pXRF assay in the 15 cm interval from 165.18 m to 165.33 m returned 3,176 g.t Ag, 0.6% Cu, 2.7% Pb and 13% Zn. (b) Similar intervals of massive mineralization occur to a depth of approximately 167 m. (c) Saw-cut half core showing detail of the 165.18 m to 165.33 m interval in photo (a).

Table 1. Portable XRF (pXRF) assays from systematic field measurements. Note that silver pXRF averages reported for the entire mineralized interval compare reasonably well with the fire assays from KCA’s laboratory (see Head Average Column in Table 2 which shows the average gold and silver grade obtained by the lab).

Note: pXRF point analyses collected with an Olympus Delta Premium X-ray fluorescence (XRF) portable spectrometer. The XRF analysis process included internal calibration at the beginning of each working day and every time the instrument was shut off for more than 15 minutes. Silica blank and two OREAS certified standards were analyzed at the beginning of each shift and after breaks. Single point analysis were collected systematically by a senior Silver One geologist every 10 cm to 25 cm throughout the entire hole. Thus, the number of single point analysis for a certain interval vary. For example, drill hole SO-C-133 contains 120 point analysis for the mineralized interval of 24 meters shot every 20 cm (24 m divided by 0.2 m = 120). 1Single point analysis every 10 cm. 2Single point analysis every 20 cm, 3Single point analysis every 25 cm. The pXRF data is taken as surface point values and may not represent the true grade and width of the sample interval.

Table 2. Summary of Cyanide Bottle-roll leach tests of drill hole composite samples. All holes are vertical holes; sample intervals are mineralized core lengths, and the respective widths are estimated to be near true widths. Core recoveries were or exceed 98%.

Note: Drill hole samples from HQ and NQ core were collected from mineralized intervals using 100% of the core. Samples weighed approximately 100 kg to 180 kg each. 1,000 grams split samples were prepared and pulverized to 0.106 millimeters, leached for 48 hours at a target 5 g/L sodium cyanide level for bottle-roll tests. Head grades were determined at the internal KCA laboratory by fire assay and atomic absorption finish (FA/AA 30 grams). Both bulk and core samples were collected, packed and delivered to KCA by Silver One personnel.

Table 3. Summary of Cyanide Bottle-roll leach tests of bulk samples.

Note: Bulk samples consist of approximately 600 kg each, collected from the floor at three separate locations at the bottom of the Mt. Diablo Pit with a backhoe and then homogenized, quartered and two opposite quarters combined for shipping. Individual samples 300 kg each were sent to KCA for testing while the rest is stored at the Candelaria mine site. 1,000 grams split samples were prepared and pulverized to 0.106 millimeters, leached for 48 hours at a target 5 g/L sodium cyanide level for bottle-roll tests. Head grades were determined at the internal KCA laboratory by fire assay and atomic absorption finish (FA/AA 30 grams). Both bulk and core samples were collected, packed and delivered to KCA by Silver One personnel.

Qualified Person

The technical content of this news release has been reviewed and approved by Robert M. Cann, P. Geo, a Qualified Person as defined by National Instrument 43-101.

About Silver One

Silver One is focused on the exploration and development of quality silver projects. The Company holds an option to acquire a 100%-interest in its flagship project, the past-producing Candelaria Mine located in Nevada. Potential reprocessing of silver from the historic leach pads at Candelaria provides an opportunity for possible near-term production. Additional opportunities lie in previously identified high-grade silver intercepts down-dip and potentially increasing the substantive silver mineralization along-strike from the two past-producing open pits.

The Company has staked 636 lode claims and entered into a Lease/Purchase Agreement to acquire five patented claims on its Cherokee project located in Lincoln County, Nevada, host to multiple silver-copper-gold vein systems, traced to date for over 11 km along-strike.

Silver One holds an option to acquire a 100% interest in the Silver Phoenix Project. The Silver Phoenix Project is a very high-grade native silver prospect that lies within the “Arizona Silver Belt,” immediately adjacent to the prolific copper producing area of Globe, Arizona.

For more information, please contact:

Silver One Resources Inc.

Gary Lindsey - VP, Investor Relations

Phone: 604-974‐5274

Mobile : (720) 273-6224

Email : gary@strata-star.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management’s current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Silver One cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Silver One’s control. Such factors include, among other things: risks and uncertainties relating to Silver One’s limited operating history, ability to obtain sufficient financing to carry out its exploration and development objectives on the Candelaria Project, obtaining the necessary permits to carry out its activities and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Silver One undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.